Intelligence that Drives your Enterprise

Intelligence that Drives your Enterprise

Enterprise

The truth is hiding in plain sight if you know where to look.

Who this Applies To

In an era of radical transparency and increased stakeholder scrutiny, managing enterprise risk is crucial for businesses across all sectors. Traditional risk assessment methods, which often rely on superficial box-checking and backward-looking financial metrics, fall short in addressing the complex risks today’s companies encounter. As a leader in this evolving landscape, Consilience harnesses advanced AI and natural language processing to transform risk identification, quantification, and mitigation.

Enterprise clients who need to manage risk and compliance.

Problem

Risk perception is subjective, with individuals viewing the same risk differently in terms of source, impact, and magnitude. This can lead to debates where influence trumps clarity, complicating decisions on whether to mitigate, insure, exploit, or ignore the risk. Moreover, understanding related risks and their interdependencies is critical. Addressing an issue in one process might unintentionally worsen another. Grasping these dynamics is key to effective risk management, whether in analyzing a business or managing your own.

The problem is clearly understanding the problem.

Solution

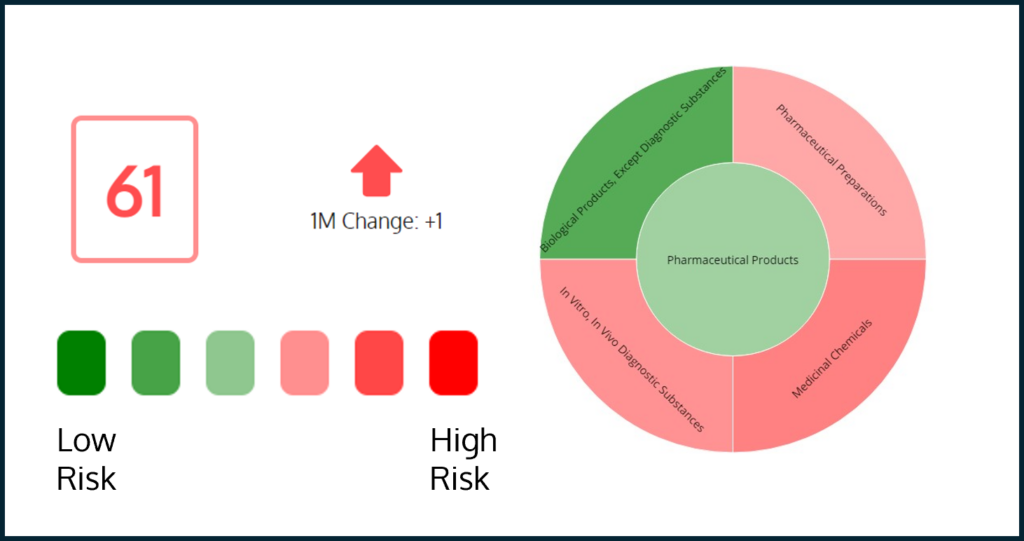

Consilience looks at your business through an investor’s lens. We identified 67 risk factors that have notable connections to performance, profitability, and market cap.

We enhance your business analysis with AI models meticulously trained on industry-specific financial text. Our bespoke, domain-specific language models are expertly tailored to your industry, minimizing the risk of inaccuracies by using curated data sets, not general internet content. We provide sentence-level audit traceability, ensuring that our insights and risk scores are transparent and verifiable. Instead of just stating your risk score is high, we show you why, grounding conversations in objective reality.

We leverage AI trained in your industry and applied to your company.

Linguistic Risk Index

At the core of Consilience’s innovative approach is the Linguistic Risk Index™ (LRI), a proprietary AI-driven tool that deciphers the subtle language of corporate disclosures to expose hidden risks. By analyzing linguistic changes in documents from earnings calls to regulatory filings, the LRI identifies vulnerabilities overlooked by traditional risk models. This enables stakeholders to penetrate beyond polished corporate narratives and discern the real risks.

Key Features:

- Adaptability and Scalability: Effective across various sectors, from financial institutions to technology firms.

- Comprehensive Analysis: Assesses stability, resilience, and operational practices.

- Objective Insights: Quantifies speculative language and evasive phrasing for a data-driven view of qualitative risk.

The LRI provides an unparalleled lens into risk factors that could significantly impact a company’s future prospects.